A Wild Ride for Wall Street—and a Wake-Up Call for Retirees

I don’t fancy myself an economist—but since 2000, I’ve had the privilege of helping over 3,000 retirees navigate these exact concerns and have trained nearly 35,000 financial advisors on how to strengthen retirement plans through every kind of market cycle.

And while this won’t be the first bout of volatility—nor the last—the case for incorporating housing wealth into retirement planning has never felt more urgent or more relevant.

In just a few short weeks, we’ve watched markets tumble nearly 20% on the heels of escalating tariff tensions, only to bounce back with a temporary rebound following news of a pause in trade actions. But beneath the recovery headlines, the bond market is signaling deeper unease. Globally, yields are wobbling, confidence is fragile, and the economic footing feels less like a solid foundation and more like shifting sand.

And here’s the thing: market volatility always matters—but it hits differently when you’re five years from retirement or already in it.

That’s the “retirement danger zone,” where a badly timed market loss doesn’t just hurt—it can shave years off a client’s financial independence. As Dr. Wade Pfau notes, a 20% early-retirement loss can cause savings to run out up to eight years sooner.

In a recent April 9th article by Ankur Singh, “Protect Retirement Savings Now: 5 Steps Amid Market Crash,” five strategies are outlined to help retirees stabilize their plans amid turmoil—everything from building a cash buffer to reevaluating spending and delaying retirement.

These are solid, time-tested moves. But what’s often overlooked is this: the modern retiree’s biggest asset is often their home. Over 80% of retirees own one, yet most financial professionals haven’t been shown how to leverage that equity to strengthen retirement outcomes and extend savings longevity.

The good news? Today’s reverse mortgage is not what it used to be. It’s a flexible, federally insured tool that aligns beautifully with the very strategies experts recommend in uncertain times.

Let’s walk through Singh’s five steps—and explore how the modern reverse mortgage can support or elevate each one.

Build a Cash Cushion (But Don’t Panic Sell)

“A 20% loss early in retirement can drain savings 8 years faster,”

—Dr. Wade Pfau, Retirement Planning Guidebook

The article recommends retirees keep 2–3 years of living expenses in accessible cash instruments, such as money market accounts or short-term Treasurys. This helps avoid selling investments at a loss during downturns.

But what if clients don’t have that kind of liquidity?

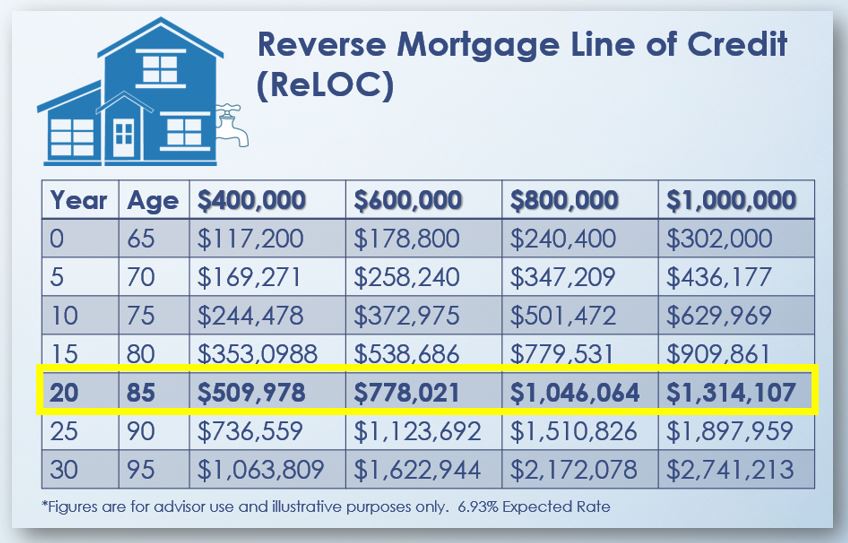

This is where a Reverse Mortgage Line of Credit (RMLOC) becomes an invaluable planning tool. It provides tax-free, non-market-correlated access to cash that grows over time when left unused. During down markets, retirees can draw from this line instead of tapping their portfolios, helping to mitigate sequence-of-returns risk.

Rebalance Your Portfolio—Carefully

The article notes that following the strong 2023–2024 bull run, many portfolios are now equity-heavy. Experts suggest keeping 50–70% in stocks for inflation-fighting growth, and allocating 5–7 years of withdrawals to bonds for stability.

But here’s the challenge: rebalancing can lead to selling during down markets.

An RMLOC can serve as a volatility buffer—a reserve retirees can draw from during downturns. This allows advisors to preserve equity positions rather than liquidating them under pressure, giving portfolios time to recover.

Trim Spending—Temporarily

To preserve assets, Singh suggests skipping inflation adjustments, reducing discretionary expenses by 20–30%, and using flexible withdrawal “guardrails” (e.g., 3% in bad years, 5% in good).

That’s sound advice—but again, what if cutting spending isn’t desirable or even possible?

Reverse mortgage proceeds can be used to supplement income temporarily, helping clients maintain their spending plan without increasing withdrawals from investment accounts. This “spending bridge” can buy time for portfolio recovery while preserving lifestyle.

Draft a Plan B (and C)

The article encourages retirees to consider flexible lifestyle plans:

- Ideal Plan: Second home, travel

- Scaled-Back: Rent a winter condo

- Bare-Bones: Downsize housing

But what if there was a smarter way to transition housing while adding back retirement dollars?

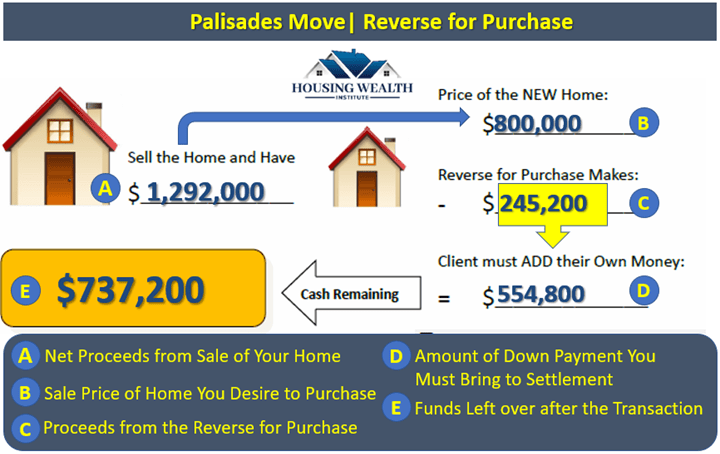

Enter the HECM for Purchase—a modern reverse mortgage that allows retirees to buy their next home with roughly 60% down and no monthly mortgage payment. This can free up hundreds of thousands in cash reserves and open the door to aging-in-place in a more suitable property. Want to See How it Works?

Delay Retirement—Even Part-Time

Singh’s final strategy suggests that working one or two more years can significantly boost savings. Even part-time work can help reduce withdrawals.

But for those who are exhausted, caregiving, or facing health concerns, working longer may not be feasible.

A reverse mortgage can eliminate an existing mortgage payment, freeing up after-tax income immediately. This reduces the pressure to draw from retirement accounts—or to delay retirement entirely. Some may even find they can comfortably work part-time or transition to retirement earlier than expected.

Conclusion: A Holistic Plan for Uncertain Times

When markets turn volatile, traditional strategies matter—but so does adaptability. That’s why the modern reverse mortgage deserves a seat at the table. As Dr. Pfau and others have highlighted, housing wealth is no longer a last resort. It’s a dynamic, tax-efficient, and flexible part of the retirement toolkit.

If you’re a financial professional looking to navigate clients through volatility with wisdom and versatility, now is the time to explore how reverse mortgages can strengthen the plan—not weaken it.

What to Do When You Have a Client or a Case?

- Go to www.HousingWealthPro.com and request a Housing Wealth Illustration. Give Details in the “Notes” Section including the clients’ phone # if they would like a Housing Wealth Assessment. You can also

- Schedule a Time to Speak with Me: Click Here

Related Articles:

- Why Top Financial Experts are Rethinking Reverse Mortgages

- 7 Ways to Lower Retirement Taxes With a Reverse Mortgage

- 50 Challenges in Retirement Income Planning Today

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667.