Implications of the Social Security Fairness Act

The Social Security Fairness Act, signed into law by President Joe Biden on January 5, 2025, marks a landmark moment for millions of public service retirees. This legislation eliminates the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO), ensuring that firefighters, teachers, and police officers, including members of the Fraternal Order of Police, can now receive the full Social Security benefits they’ve earned. Retirees impacted by these provisions will see an average monthly increase of $360, along with retroactive lump-sum payments for 2024—a significant financial boost for middle-class households.

President Trump’s Support and Proposed Initiatives

President Donald Trump, who assumed office on January 20, 2025, has expressed strong support for the Social Security Fairness Act. In alignment with his advocacy for public servants, Trump has engaged with organizations like the Fraternal Order of Police to emphasize his commitment to retirees. However, the legislation presents financial challenges: economist David A. Weaver notes that it adds $195 billion to the federal deficit over the next decade. This fiscal pressure has prompted policymakers, including President Trump, to explore innovative solutions to enhance retirees’ financial independence while easing the burden on government programs.

On his first day in office, President Trump issued executive orders aimed at reducing housing and energy costs by cutting regulations that inflate consumer prices. Additionally, his expressed interest in privatizing Fannie Mae and Freddie Mac could have significant implications for the housing market, including reverse mortgage strategies. These developments, highlighted by Newsweek, Investopedia, and Barron’s, underline the importance of housing wealth in retirement planning.

What Does This Mean for Reverse Mortgages in 2025?

Greater Financial Flexibility for Retirees

The additional Social Security income provides retirees with enhanced financial stability, potentially reducing the immediate need to tap into home equity through a reverse mortgage. However, it could also open doors for more strategic uses of reverse mortgages:

- Deferring Reverse Mortgage Draws: Higher Social Security benefits allow retirees to delay drawing on reverse mortgage lines of credit. This delay enables the credit line to grow, offering a more robust safety net for future needs like healthcare or long-term care.

- Supplementing Retirement Plans: Despite increased benefits, some retirees may still face gaps in their retirement income plans. Reverse mortgages remain a powerful tool for bridging these gaps, ensuring sustainable cash flow and extending the longevity of retirement savings.

Addressing Trust Fund Concerns with Reverse Mortgages

While the Social Security Fairness Act enhances benefits for millions, it also adds $195 billion to the federal deficit over the next decade. This fiscal pressure may prompt policymakers to explore innovative ways to bolster retirees’ financial independence without over-reliance on government programs.

Reverse mortgages, backed by robust academic research, could gain traction as a private-sector solution to help retirees optimize cash flow and preserve their Social Security benefits for as long as possible. By strategically integrating reverse mortgages, retirees can reduce their dependence on traditional income streams, potentially alleviating pressure on government resources.

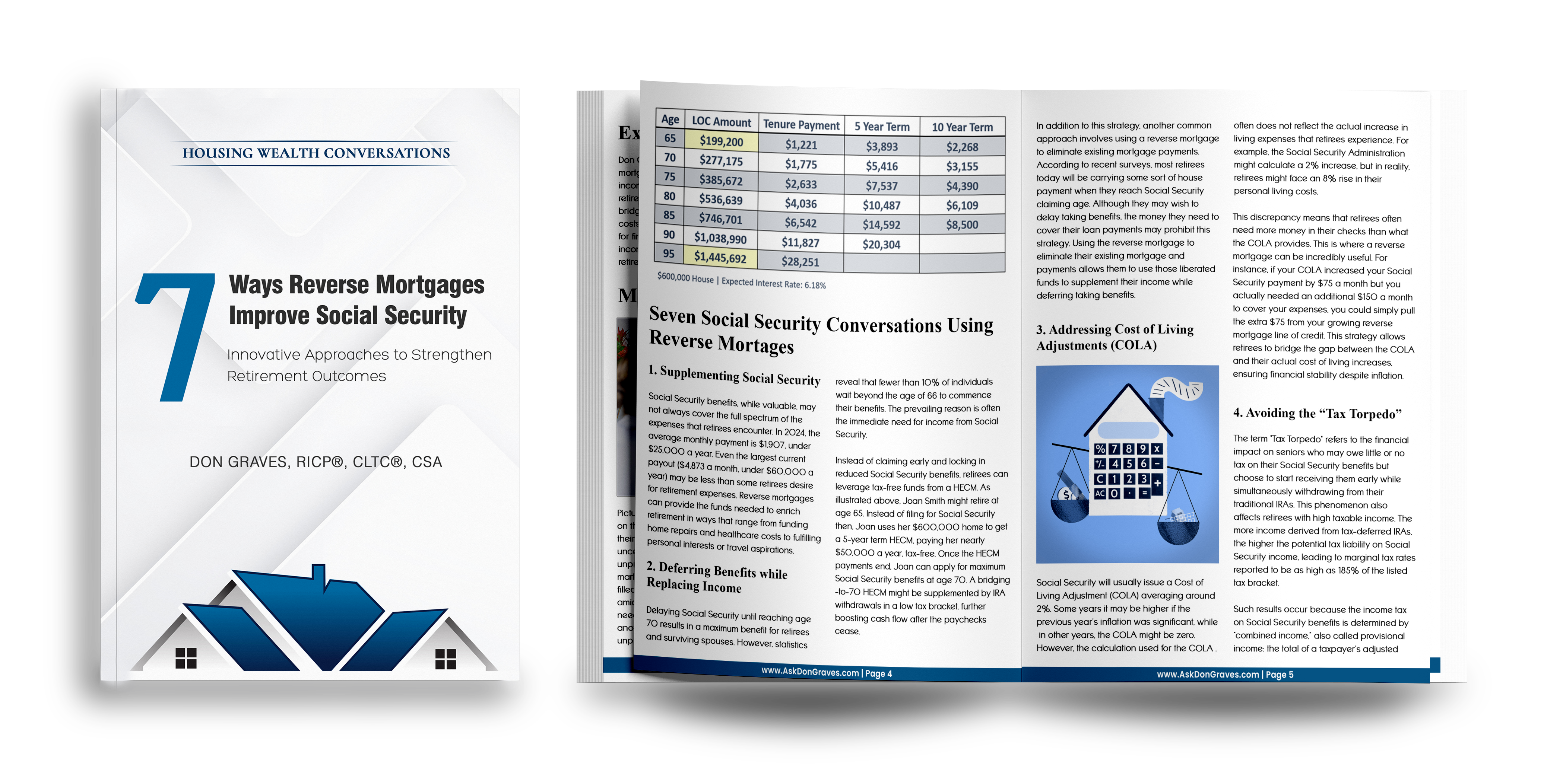

Free Report for Download: 7 Ways Reverse Mortgages Improve Social Security Planning

Learn how reverse mortgages can enhance your Social Security strategy with our free report, “7 Ways Reverse Mortgages Improve Social Security Planning.” Discover practical strategies to:

(If you are unable to download the article, Please Click Here and we will get it to you another way)

Opportunities for Advisors

The new legislation presents a unique opportunity for financial advisors to deepen retirement planning conversations with clients. By leveraging the enhanced Social Security benefits in tandem with reverse mortgage strategies, advisors can help clients:

- Mitigate Tax Liabilities: Reverse mortgages can fund Roth conversions, allowing retirees to shift assets into tax-free accounts while managing income thresholds.

- Optimize Income Streams: Coordinating Social Security benefits with housing wealth strategies ensures a more stable and sustainable retirement income plan.

- Address Major Expenses: Reverse mortgages provide a flexible option to cover large expenses such as healthcare, long-term care, or home modifications without liquidating other assets.

- Enhance Client Relationships: Offering tailored strategies that integrate Social Security and reverse mortgages positions advisors as comprehensive, forward-thinking professionals who prioritize their clients’ long-term financial well-being.

A Promising 2025 for Retirees and Reverse Mortgages

The Social Security Fairness Act, supported by President Trump, restores fairness and dignity to retirees long affected by outdated provisions. At the same time, the fiscal challenges it creates demand creative solutions. For retirees, reverse mortgages represent a valuable tool to achieve financial stability, while for advisors, they offer a way to enhance client outcomes and build stronger relationships.

By staying informed and embracing strategies that integrate housing wealth with enhanced Social Security benefits, financial advisors can help clients achieve their retirement goals with confidence in 2025 and beyond.

Related Articles and Resources

What to Do When You Have a Client or Case?

- Go to www.HousingWealthPro.com and request an Housing Wealth Illustration. Give Details in the “Notes” Section including the clients phone # if they would like a Housing Wealth Assessment. You can also

- Schedule a Time to Speak with Me: Click Here

Original Article can be found: https://www.cbsnews.com/news/social-security-fairness-act-signed-by-president-biden/

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667.