A New Day is Dawning

For the last 25 years, I have focused exclusively on helping financial professionals understand the value and beauty of how a well-positioned reverse mortgage can transform retirement outcomes. It’s been my passion to show advisors how housing wealth can provide stability, flexibility, and new opportunities for their clients.

Over the last several years, with historically low interest rates, many savvy homeowners (myself included) took advantage of the opportunity to refinance into rates as low as 2.5%, 3%, or 3.5%. Those low rates raised an important question for retirees and their advisors: “Why would I ever consider a reverse mortgage if it means giving up my current low-interest mortgage?”

For many, a traditional reverse mortgage makes perfect sense, but for homeowners with higher home values and significant first mortgage balances, refinancing into a new loan can feel like a step backward. Fortunately, there’s a new solution designed specifically for homeowners in this position: a reverse mortgage that allows you to retain your low-interest first mortgage while accessing additional funds through a second lien reverse mortgage.

This innovative option delivers unmatched flexibility and financial security, whether the goal is to eliminate a costly HELOC, consolidate debt, or simply pull out extra cash—all while keeping your first mortgage intact.

Let me share how real homeowners are using this game-changing solution to achieve their financial goals.

What The HomeSafe® Second Can Do For You

Ease the impact of inflation and uncertainty

Get cash to improve your budget, battle rising costs, and protect against economic uncertainty.

Fund home renovations

Pay for home improvements that make your home safer, more enjoyable, and more suitable to your lifestyle.

Pay off higher-interest debts

Tackle higher-interest consumer debt, like credit cards, and create financial breathing room.

Cover medical expenses

Address ongoing medical expenses, emergencies, and long-term care.

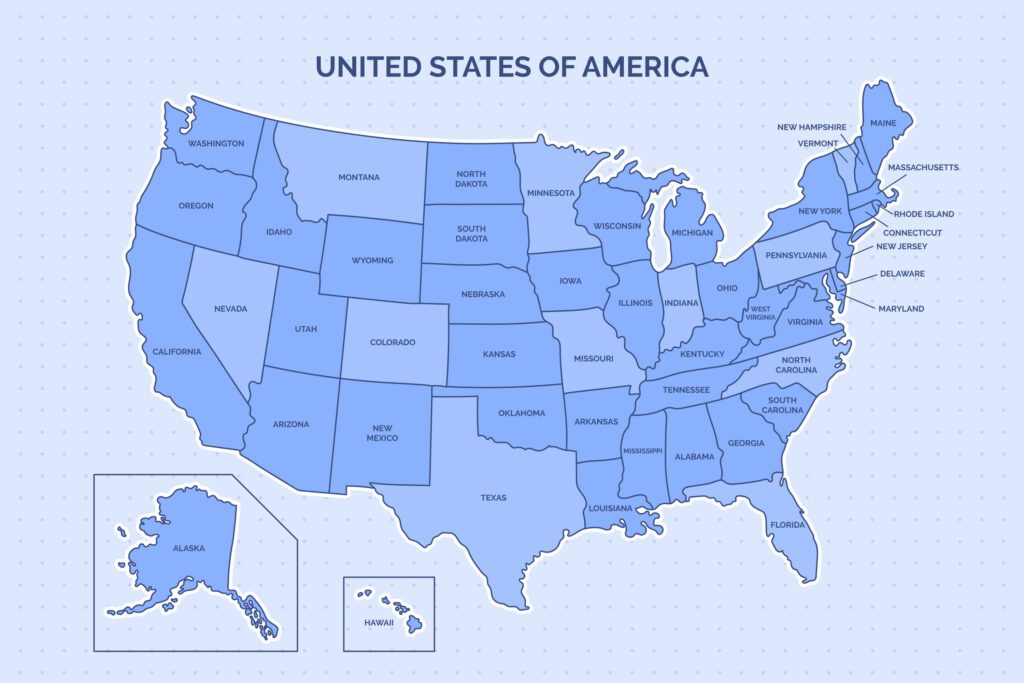

What States Offer the HomeSafe® Second?

The HomeSafe® Second is currently (Sept. 2025) available in the following states:

- California

- Texas

- Colorado

- Utah

- Florida

- South Carolina

- Arizona

- Nevada

- Oregon

- Connecticut

- Montana

- Illinois

New states are continuously being added as this innovative program expands. Be sure to check with your reverse mortgage partners to confirm availability in your area and stay updated on the latest developments.

Real-Life Case Studies: How HomeSafe® Second Makes a Difference

Case Study 1: Replacing a High-Cost HELOC

A couple with a $2.5 million home had a 30-year fixed-rate mortgage at 2.69% but were struggling with a HELOC (Home Equity Line of Credit) set to recast at 11.58%. The looming increase in monthly payments was unmanageable, as their payment was set to jump from $1,100 to $2,800 per month.

- By choosing the HomeSafe® Second, they eliminated the HELOC entirely while keeping their first mortgage untouched.

- The result: Immediate relief from skyrocketing monthly payments, with long-term financial stability.

Case Study 2: Funding Upgrades Without Touching a Favorable First Mortgage

A 65-year-old couple with an $800,000 home and a $250,000 first

mortgage at 2.89% wanted to access funds for much-needed home upgrades. While they were comfortable with their current mortgage payment, refinancing their existing loan would mean losing their low 2.89% interest rate—a step they were eager to avoid. They also recognized that completing these upgrades would further increase their home’s value and overall comfort.

The HomeSafe® Second offered the perfect solution:

- They were able to retain their current low-rate mortgage.

- They accessed an additional $153,000 through the second lien reverse mortgage to cover the cost of repairs and upgrades.

Because the HomeSafe® Second does not require monthly repayments, the couple could complete the necessary upgrades stress-free, without increasing their ongoing financial obligations.

The result: The couple successfully improved their home’s value and livability while keeping their existing low-interest mortgage intact. They achieved their goals without sacrificing financial stability or taking on additional monthly debt.

Case Study 3: Accessing Funds Without Refinancing or Sacrificing Investments

A homeowner with a $3.5 million home and a $1 million mortgage at 3% wanted to access an additional $400,000 to support retirement goals. While he could have pulled the money from his securities portfolio, doing so would have triggered a high tax liability and forfeited all the future growth potential on those investments.

- By choosing the HomeSafe® Second, he accessed the funds he needed tax-free and with no monthly repayment required, all while keeping his favorable first mortgage intact.

- The result: A smart financial solution that preserved his existing investments, avoided tax consequences, and provided the cash he needed without sacrificing long-term growth.

Case Study 4: Building Rental Income and Creating Financial Freedom

A homeowner with a $6 million home and a $1.3 million mortgage at 3% wanted to increase her household cash flow by building two auxiliary dwelling units (ADUs) on her property. While typical ADU construction costs in her area exceed $200,000 per unit, her expertise as an architect allowed her to complete the project for a total of $600,000, saving significantly on construction expenses.

She utilized the HomeSafe® Second to access $1 million in funds:

- $600,000 to cover the construction costs for the ADUs.

- $400,000 to pay down and re-amortize her first mortgage, effectively lowering her monthly payments.

While interest accrues on the HomeSafe® Second, no monthly repayment is required, meaning 100% of the rental income generated by the ADUs goes directly into her household cash flow.

The result: By leveraging her professional expertise and the HomeSafe® Second, she successfully created new income streams while simultaneously reducing her existing mortgage costs. All of this was accomplished without giving up her low 3% interest rate or adding monthly repayment obligations

Frequently Asked Questions

What is HomeSafe® Second?

HomeSafe® Second is a second lien and HELOC alternative that turns a piece of home equity into cash without the burden of a new monthly mortgage payment or the need to refinance*

How does HomeSafe® Second work?

HomeSafe® Second loans you a portion of your home equity as a second mortgage. You receive these funds via a lump sum and are not required to make an additional monthly mortgage payment on this cash.*

Who is HomeSafe® Second for?

HomeSafe® Second is for homeowners 55+** who want to preserve their current mortgage rate while gaining access to a portion of their home equity. For those considering a HELOC, it can be a strategic alternative with the unique advantage of not requiring a new monthly mortgage payment*

How does HomeSafe® Second differ from a HELOC?

HomeSafe® Second and home equity line of credit (HELOC) offer homeowners different options for accessing a portion of their home equity. HomeSafe Second provides a one-time lump sum payment with no new monthly mortgage payment required.* A HELOC offers ongoing access to home equity, requiring a monthly payment on the money withdrawn.

What happens at the end of a HomeSafe® Second loan?

HomeSafe® Second loan is repaid when the homeowner moves out, doesn’t meet the loan conditions, or passes away. The loan can be settled by selling the house or by using other assets if the borrower or heirs prefer to keep the house. Most importantly, the borrower or heirs won’t owe more than the home’s value.

Learn More: A Better Reverse Mortgage for High Value Homes

*The borrower must meet all loan obligations, including meeting all loan obligations under the first lien mortgage, living in the property as the principal residence and paying property charges, including property taxes, fees, hazard insurance. The borrower must maintain the home. If the homeowner does not meet these loan obligations, then the loan will need to be repaid.

**For certain HomeSafe® products only, excluding Massachusetts, New York, and Washington, where the minimum age is 60, and North Carolina and Texas where the minimum age is 62.

Below Are Some Specifics of the Program:

The HomeSafe® Second is designed with flexibility and high-value homeowners in mind.

Program Highlights:

- Loan Amounts: Minimum principal limit of $150,000 up to a maximum of $4,000,000.

- Fixed Rate: Predictable terms with no rate surprises.

- Origination Fee: $3,995.

- No Mortgage Insurance Premiums: No upfront or monthly MIP required.

- Non-Recourse Loan: Neither borrowers nor heirs owe more than the home’s value.

- Repair Set-Aside: Allowed if repairs are necessary to meet program guidelines.

- Financial Assessment: Streamlined for qualified borrowers.

- No Minimum Property Value: High-value homes are eligible without restrictions.

Eligibility Requirements:

- Age: Minimum of 55 years.

- Existing First Mortgage: Must be fully amortized, fixed-rate, and in good standing.

- Ineligible Mortgages:

- Interest-only loans

- Adjustable-rate mortgages (ARMs)

- Negatively amortizing loans

- Private lender loans

- Reverse mortgages (including HECMs)

- Property Types:

- Single-family homes

- Planned Unit Developments (PUDs)

- Condominiums and townhomes

- 2–4 unit properties

Loan-to-Value (LTV) Limits:

| Age | CLTV | LTV Cap |

| 55-61 | 50% | 15% |

| 62-79 | 55% | 20% |

| 80+ | 60% | 25% |

Current Credit and Income Requirements

To qualify for the HomeSafe® Second, borrowers must meet the following credit and income criteria:

- Credit Score ≥ 680:

- May qualify for a streamlined financial assessment with minimal documentation.

- Requirements include:

- Zero 30-day mortgage lates in the past 24 months.

- Current property charges (taxes, insurance, HOA) with no delinquencies in the past 12 months.

- Sufficient income or loan proceeds/asset dissipation to meet program guidelines.

- Credit Score 600 – 679:

- Requires a full financial assessment to determine eligibility.

- FAR allows non-mortgage installment debt to be paid off to meet financial requirements.

- If credit card debt is paid off, the principal limit will be reduced by 5%.

- Credit Score < 600:

- Borrowers do not qualify for the HomeSafe® Second.

- No Credit Score:

- Borrowers must have a credit score from at least 2 of the 3 repositories.

- If no score is available, eligibility will be considered on a case-by-case basis and must be reviewed by a VP or higher for approval.

Financial Assessment Highlights:

- Streamlined assessment available for borrowers with:

- Zero 30-day lates on their mortgage in the past 24 months.

- Current property charges (taxes, insurance, HOA) for the past 12 months.

- A credit score of ≥680 or better.

- Borrowers who do not qualify for streamlined assessment may complete a full financial review.

Conclusion: Is the HomeSafe® Second Right for Your Clients?

Do your client homeowners fit these criteria:

- Age 55 or Older?

- Desire to Remain in their Home?

- Have a Low Interest Fix Rate Mortgage they are comfortable paying?

- Have a second Loan or HELOC that is resetting and they would like to get rid of that payment?

- Would like to access more of their homes equity without incurring new monthly mortgage payments?

The HomeSafe® Second is a game-changing solution for retirees who want to access their home’s equity without disrupting their low-interest first mortgage. Whether you’re eliminating a costly HELOC, consolidating debt, funding retirement goals, or generating additional income, this innovative product delivers unmatched flexibility and financial security.

If you’re ready to explore how the HomeSafe® Second can work for you, reach out today to learn more about this groundbreaking reverse mortgage solution.

What to Do When You Have a Client or a Case?

- Go to www.HousingWealthPro.com and request a Housing Wealth Illustration. Give Details in the “Notes” Section including the clients’ phone # if they would like a Housing Wealth Assessment. You can also

- Schedule a Time to Speak with Me: Click Here

Related Articles:

- A Better Reverse Mortgage for High-Value Homes

- Unlocking Retirement Potential: Five Ways the Modern Reverse Mortgage Benefits Your Clients

- Squeezing the Juice Out of Retirement: Understanding the Four Psychological Phases of Retirement

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667.