The Swiss Army Knife

One of the most overlooked features of the modern reverse mortgage is the growing line of credit. I was cited in a Forbes article as coining the phrase “the Swiss Army knife of retirement income planning,” because it’s flexible, reliable, and uniquely designed to give retirees long-term security.

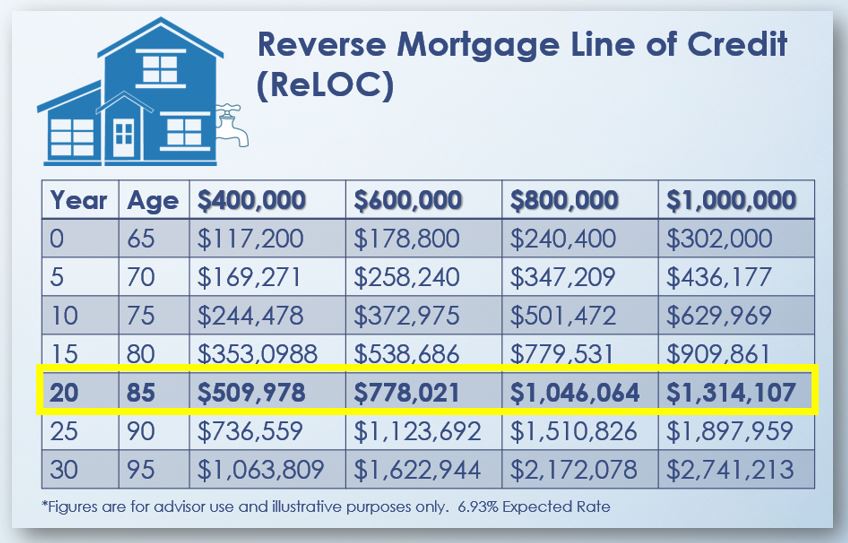

Here’s the surprising part: when you open a Home Equity Conversion Mortgage (HECM) and leave some of the funds unused, your available line of credit doesn’t just sit still, it actually grows over time. And this growth happens independent of your home’s value.

A Few Basic Terms

- Your reverse mortgage establishes a Principal Limit (the total amount available).

- From that, any payoff of an existing mortgage or closing costs is subtracted.

- The remainder is starting line of credit also referred to as the Remaining Principal Limit

So, How Does It Grow?

- Each year, the principal limit increases at the loan’s effective rate, commonly called the interest rate.

- Your outstanding balance only grows on any proceeds you borrowed and financed closing costs.

- The difference between the two creates an expanding pool of available funds — your line of credit.

For a step-by-step walk-through with numbers on the screen, watch the short video below. You’ll see exactly how the math works, and why this feature has been called a game-changer for retirement planning.

Ready to Learn More?

If you’re a financial advisor or a retiree wondering how housing wealth could fit into your planning conversations, I invite you to explore further:

- Watch the 7-minute masterclass introduction: www.FirstSevenMinutes.com

- Try the calculator: www.HousingWealthCalculator.com

- Speak with Don: www.AskDonGraves.net

Let’s stop ignoring the largest asset many retirees own. The shift is already happening, and it’s changing lives.

Related Posts:

- 6 Ways Reverse Mortgages Can Manage Rising Insurance Costs

- Why Waiting to Secure a Reverse Mortgage Could be a Costly Mistake

- Can a Reverse Mortgage Happen When One Spouse is Under 62?

What to Do When You Have a Client or Case?

- Go to www.HousingWealthPro.com and request an Housing Wealth Illustration. Give Details in the “Notes” Section including the clients phone # if they would like a Housing Wealth Assessment. You can also

- Schedule a Time to Speak with Me: Click Here

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667