Mr. and Mrs. Jones are 65, newly retired, and like many people in their position they went straight to their bank to ask about a line of credit “just in case.” The only option they were offered (and the only one they knew existed) was a standard Home Equity Line of Credit (HELOC). What they didn’t know is that a HELOC can work directly against the goals most retirees have for stability, cash-flow, and risk management, while a reverse mortgage line of credit is built for the realities of retirement.

Before another retiree makes the same assumption, here is what advisors need to understand about HELOCs vs. Reverse Mortgage Lines of Credit (RELOC) and how to help clients avoid avoidable mistakes.

The Hidden Pitfalls of a HELOC

For the Joneses, the HELOC seemed simple and harmless, until they learned what happens after you sign.

That brings us to the part most retirees never get told upfront.

Mandatory monthly payments of principal and interest

Call risk if values drop or credit changes (“call risk” means the lender can freeze, cap, cancel, reduce, with changing economic conditions. In 2008, many folks who had existing HELOCs discovered this reality)

Expiration of the draw period when retirees are older and more vulnerable (typical draw period will last about 5-10 years)

The RELOC Advantage

A RELOC, the reverse mortgage line of credit, was designed specifically for retirees:

No required monthly mortgage principle and interest payments—all monthly mortgage principle and interest payments are voluntary

Guaranteed access as long as obligations are met. The requirements are:

Live in the home as the primary residence of at least one borrower

Maintain the property

Pay property related charges (taxes, HOA fees)

- Keep Homeowners Insurance in force

Growing line of credit that can increase over time. The initial benefit amount is based on three factors:

- Age of the younger spouse

- Home value up to the lending limit

- Expected interest rate (future projected interest rate)

Longevity protection with no set expiration date

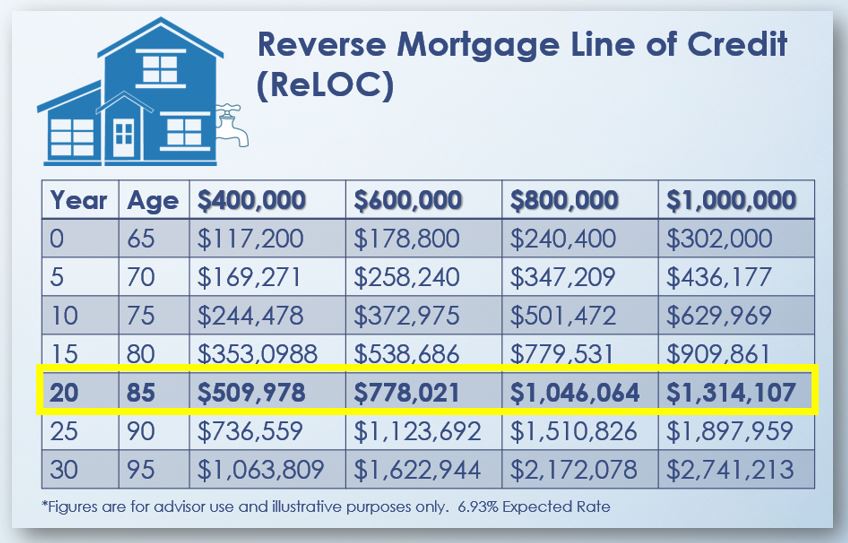

As you can see in the chart below, the Joneses were able to receive an initial line of credit of about $178,800 in their $600,000 home. This assumes that there are no existing loan balances against the property (1st or 2nd mortgage, home equity loan, or home equity line of credit).

HELOC vs. RELOC at a Glance

| Feature | HELOC (Home Equity Line of Credit) | RELOC (Reverse Mortgage Line of Credit) |

|---|---|---|

| Payments | Mandatory monthly principal & interest | No required principle and interest payments (voluntary only) |

| Access to Funds | Can be frozen, reduced, or canceled by lender | Guaranteed as long as borrower meets loan obligations |

| Term Length | Short (draw period 5–10 years, then repayment) | Lasts as long as borrower lives in home |

| Eligibility | Based on credit score, income, and debt ratios | Based primarily on age, home value, and equity |

| Line of Credit Growth | None—unused funds don’t grow | Unused funds grow over time, increasing borrowing power |

| Repayment Risk | Balance becomes due at end of term, often later in retirement | Balance due only when borrower leaves home, sells, or passes away |

| Best Fit | Younger borrowers still earning income | Retirees seeking flexibility and security |

Why the Differences Matter

Imagine if the Joneses took out a HELOC for $100,000. Ten years later, when they’re 75, the draw period ends and the repayment schedule begins, just when their income is fixed and medical costs are rising.

Instead, the Joneses decided on a RELOC, so they now have access to a growing line of credit with no required monthly principle and interest payments. Instead of draining cash flow, the RELOC will remain a flexible reserve.

Helping Clients Avoid Costly Mistakes

Advisors who understand the difference can guide clients toward strategies that protect their retirement stability. HELOCs may work for younger households, but for retirees, the RELOC often provides the flexibility and security they need.

Bottom Line

The wrong choice can turn a solution into a problem. Helping clients understand why a RELOC often makes more sense than a HELOC may be one of the simplest and most impactful ways to protect their long-term well-being.

Related Posts:

- 6 Ways Reverse Mortgages Can Manage Rising Insurance Costs

- Why Waiting to Secure a Reverse Mortgage Could be a Costly Mistake

- Can a Reverse Mortgage Happen When One Spouse is Under 62?

What to Do When You Have a Client or Case?

- Go to www.HousingWealthCalculator.com and preview potential reverse mortgage benefits.

- Schedule a Time to Speak with Me: Click Here

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667