What Can a Tax Return Reveal About Retirement Readiness?

You don’t need to be a CFP to spot when something’s off in a retiree’s financial life. Often, the warning signs show up first in the tax return.

For clients over 62, the 1040 doesn’t just track income—it surfaces stress points. You’ll see clues about unsustainable drawdown rates, bracket creep, shrinking cash reserves, and taxed-to-death Social Security checks. But few advisors realize how often those clues point to one largely untapped source of relief: housing wealth.

A modern reverse mortgage offers tax-free cashflow, optional payments, and strategic flexibility. It doesn’t just fit into a retirement plan—it can reshape one.

What Is a Reverse Mortgage?

A reverse mortgage is a federally insured loan for homeowners age 62 or older that allows them to convert a portion of their home’s equity into tax-free cash—without selling the home, giving up ownership, or taking on a required monthly mortgage payment.

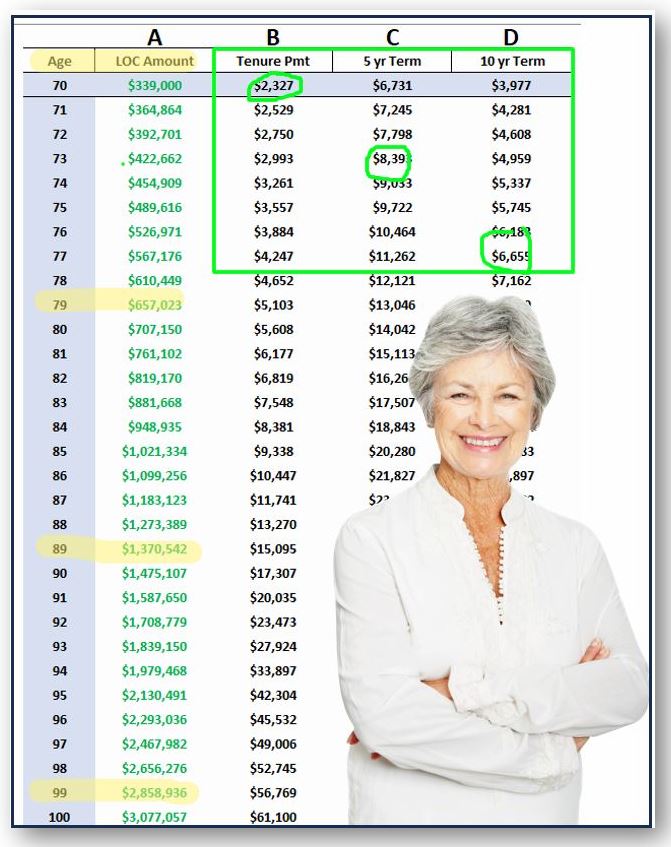

The amount available is based on three key factors: the age of the youngest borrower (or eligible non-borrowing spouse), the value of the home, and current interest rates. For example, a 70-year-old couple with a $850,000 home might qualify for approximately $345,000 to $308,000 in reverse mortgage proceeds at today’s rates.

Because a reverse mortgage must be the first mortgage on the property, any existing loans will be paid off at closing. Whatever is left becomes accessible as a growing, tax-free line of credit that can be used at any time—for income, emergencies, Roth conversion taxes, long-term care costs, or simply as a standby reserve.

The Growing Line of Credit (GLOC)

Below is an example of a initial line of credit of $339,000 and its potential growth (A) and convertibility (B,C,D) which shows how in any given year the GLOC could be converted into a monthly payment for the Life of the Loan (B) or 5 and 10 years draw periods (C/D) The truth is that this is just a snapshot of the flexibility of the reverse mortgage line of credit as a retirement planning resource.

Why This Matters for Tax Pros

Most homeowners over 62 are sitting on hundreds of thousands—sometimes millions—in home equity. And yet, many of these same clients are:

- Drawing down taxable accounts too quickly

- Paying more in taxes than necessary

- Postponing needed care

- Quietly worried they’ll outlive their savings

As a reverse mortgage educator and planner with 25 years of experience, I can tell you: when used strategically, a reverse mortgage becomes more than a last resort—it becomes a tax-optimized, cashflow-flexible retirement planning tool.

So how do you know when to bring it up?

Start with the return. Here are 15 red flags or conversation starters you can spot before your client ever says a word.

15 Clues Hidden in the 1040 That May Call for a Reverse Mortgage Conversation

Does your client…

Own a home with significant equity?

Have a monthly mortgage payment that strains cashflow or limits savings?

Prefer to make that payment optional—without selling their home?

Show taxed Social Security benefits from excess provisional income?

Appear on the edge of a higher tax bracket due to RMDs or investment income?

Lack sufficient income or assets to confidently last through their full life expectancy—plus 5 years?

Pull regular withdrawals from retirement accounts to meet everyday needs?

Have a spouse whose death would reduce household income but not expenses?

Lack liquid, non-taxable resources for medical or emergency needs?

Show drawdown patterns that may trigger penalties or tax inefficiencies over time?

Have no plan to fund long-term care expenses or coverage?

Talk about downsizing or relocating purely for financial reasons?

Want to pursue Roth conversions but balk at the tax hit?

Have a portfolio too exposed to market downturns without a safety net?

Wish they had one more tax-free bucket of money—just in case?

Why This List Matters

These aren’t just numbers. They’re prompts. Indicators. Early warning signals that your client may be heading toward an inflexible or inefficient retirement—and that it’s time to bring housing wealth into the conversation.

Not as a product, but as a planning tool.

Five Case Studies That Bring These Ideas to Life

Case Study 1: Bill and Sandy, 65/63 | Newly Retired

Bill and Sandy scheduled a review meeting after visiting their accountant. When their advisor reviewed the return, he asked if their retirement dreams had changed.

They admitted they felt a little concerned about unexpected expenses, long-term care, and whether they’d outlive their savings.

Their advisor noticed they were still paying a $1,500 mandatory monthly mortgage payment. When asked if they’d prefer that payment to be mandatory or voluntary, they quickly answered, “Voluntary!”

He showed them a Customized Housing Wealth Illustration that addressed all three concerns without changing their financial behavior. They were amazed how one overlooked asset could create such peace of mind.

Case Study 2: Evelyn, 72 | Widow, Retired Librarian

Evelyn’s tax return showed her Social Security was being heavily taxed due to IRA withdrawals. With no long-term care coverage and few liquid assets, she was concerned about future expenses but hesitant to touch her remaining savings.

Her advisor introduced a housing wealth strategy using her paid-off $650,000 home. It created a tax-free reserve and allowed her to reduce taxable withdrawals without sacrificing her lifestyle.

Tears welled up as she said, “I never imagined my home could take care of me the way I took care of it.”

Case Study 3: Greg and Darlene, 68/66 | Small Business Owners

Greg and Darlene’s tax return showed rising income and a looming RMD problem. They wanted to do Roth conversions but didn’t want the tax hit.

Their advisor asked, “What if you didn’t have to touch your portfolio to cover the taxes?”

By accessing equity in their $850,000 home, they funded a 5-year Roth strategy, reduced lifetime taxes, and protected their legacy—without drawing down investments.

Case Study 4: Bob and Sally, 73 | Retired Couple

Bob and Sally live in a $700,000 home with a $200,000 mortgage. Their tax return showed interest deductions but also flagged excess IRA withdrawals that increased their tax bill.

They were “just trying to be safe,” they said. Their advisor showed how eliminating the mortgage payment through a reverse strategy could reduce taxable income and provide flexibility for future needs.

They responded, “Why didn’t anyone tell us this sooner?”

Case Study 5: Bill, 68 | Retired Engineer

After selling highly appreciated stock to cover a family expense, Bill was shocked by the capital gains taxes. His advisor asked, “What if there was a way to access funds for future needs—without creating more taxes?”

A housing wealth strategy allowed Bill to create a liquid, tax-free buffer and preserve his portfolio for future growth.

The Tax Return Is More Than Math—It’s a Map

Every 1040 tells a story. Not just about what’s been earned or spent, but about where your client is headed, and whether their plan will get them there.

Too often, tax returns are treated as paperwork to be filed away. But for advisors and tax professionals willing to look a little deeper, they can be one of the most revealing—and underused—tools in planning.

They show us the pressure points. The gaps. The “something’s not quite right here” signals that could be hiding real financial stress. And in many cases, they show us where housing wealth might play a meaningful role.

A reverse mortgage isn’t for everyone. But for the right client, at the right time, it can create flexibility, reduce tax strain, and turn home equity into a financial resource instead of a dormant asset.

So the next time you’re reviewing a return, pause and ask: What’s the real story here? Is there a way we can help this client retire not just with a refund—but with confidence?

What to Do When You Have a Client or a Case?

- Go to www.HousingWealthPro.com and request a Housing Wealth Illustration. Give Details in the “Notes” Section including the clients’ phone # if they would like a Housing Wealth Assessment. You can also

- Schedule a Time to Speak with Me: Click Here

Related Articles:

- Seven Ways to Lower Retirement Taxes With a Reverse Mortgage

- Creating a Long-Term Care Health Plan with Reverse Mortgages

- How to Uncover the Social Security Time Bomb

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667.