When a Mortgage Stalls a Retirement Plan: A Personal Story of Options and Change

It started with a familiar tension. A couple had worked hard, saved steadily, and done most things right, but their monthly mortgage and rising expenses were draining their energy and their IRA. They didn’t want handouts or drastic changes. They just wanted options.

Their advisor, someone who had once been skeptical of using housing wealth, took a second look. What he discovered changed everything. By tapping into the value of their home, they found a way to eliminate their mortgage payment, protect their retirement savings, and gain breathing room to think more clearly about legacy, Social Security, and long-term goals.

Because retirement isn’t just about having income. It’s about having choices.

Meet the Johnsons

“We thought we had to choose between our lifestyle today and our legacy tomorrow.”

That’s how the Johnsons described the financial tension they were feeling when they sat down with Charles, a Certified Financial Planner. On paper, they had done many things right—paid down a good portion of their mortgage, built retirement savings, and made wise decisions about delaying Social Security and maintaining life insurance. But beneath the surface, they were feeling squeezed.

At ages 66 and 62, the Johnsons were facing a retirement filled with difficult trade-offs. Their $750,000 home still carried a $265,000 mortgage, costing them $1,500 per month. They were withdrawing $15,000 per year from their $300,000 IRA to help cover expenses—but they were becoming uneasy about how quickly that could erode their long-term savings.

Neither had claimed Social Security. Mr. Johnson had already retired and hoped to delay benefits until full retirement age—66 and 10 months—or even until 70 to receive the maximum benefit. Mrs. Johnson, still working part-time due to health concerns, was also hoping to defer her benefit. But between the mortgage and ongoing IRA withdrawals, the pressure was mounting.

Mrs. Johnson wanted to remain in the home she loved. Mr. Johnson was open to moving if it meant relieving some financial stress. They weren’t looking for drastic change—they were simply looking for options.

A Shift in Perspective: The Advisor’s Journey

Before Charles could offer them one, he had to experience a shift of his own.

Like many advisors, Charles had long been skeptical of reverse mortgages. He’d heard the myths and assumptions echoed throughout the industry:

“You lose your home.”

“They’re too expensive.”

“It’s only for desperate people.”

He hadn’t taken the time to investigate whether those beliefs still held true—or whether they had ever been entirely accurate.

That changed when Charles attended a national industry event where I spoke on the main stage. Something in the presentation resonated—not just the numbers, but the logic behind using housing wealth as a non-correlated, tax-efficient asset. It wasn’t a product pitch—it was a planning framework.

Intrigued, Charles began to dig deeper. He listened to my Morningstar podcast on reverse mortgages titled “Are Reverse Mortgages a Smart Move?” and began reviewing the latest research from academics like Dr. Wade Pfau, The American College, and Morningstar itself.

What he discovered changed his mindset.

The modern reverse mortgage—specifically the federally insured Home Equity Conversion Mortgage (HECM)—was flexible, strategic, and often perfectly suited to retirees looking to balance cash flow, tax efficiency, and legacy planning.

This shift in understanding led Charles to look at the Johnsons’ situation through a new lens—and it opened the door to a planning conversation that would change everything.

A Strategic Shift: Considering Housing Wealth

When Charles introduced the idea of a reverse mortgage, the Johnsons were cautious. They, too, had heard the myths:

“You lose your home.”

“It’s only for people in trouble.”

“It’s a last resort.”

But when they looked more closely, they realized much of what they believed was outdated or simply incorrect.

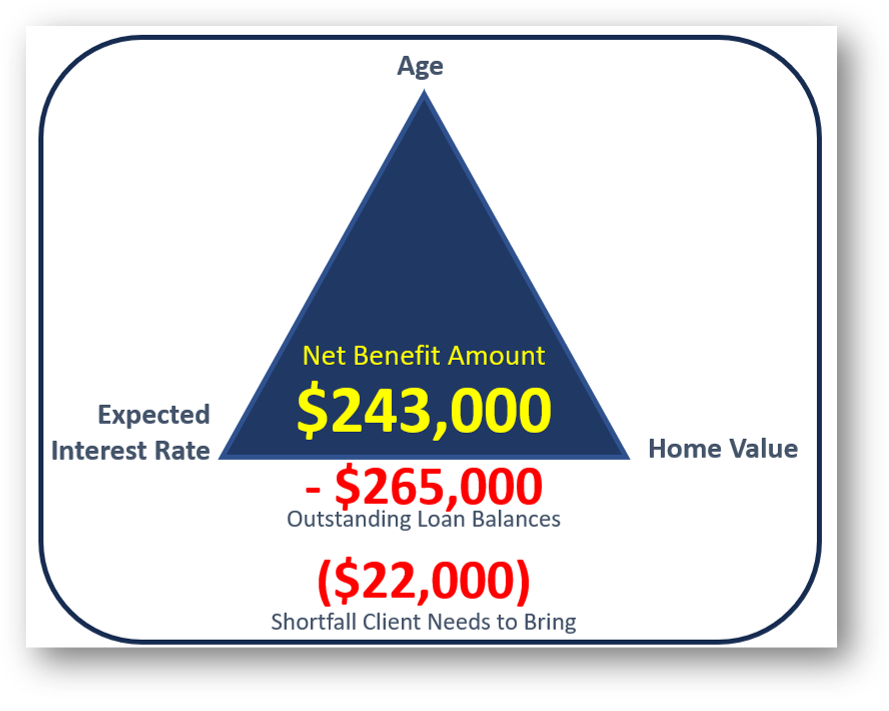

Charles explained that reverse mortgage benefits are determined by three factors:

The age of the youngest borrower (older equals more access)

The appraised value of the home

The expected interest rate, based on the 10-year Treasury

In their case, the youngest spouse was 62, the home was valued at $750,000, and while interest rates had risen, the numbers still worked. The reverse mortgage could make approximately $243,000 available to them.

It wasn’t quite enough to pay off their $265,000 mortgage—they’d need to bring $22,000 to closing. But rather than seeing that as a problem, they saw it as an opportunity.

But instead of seeing that as a problem, they saw it as an opportunity. By taking a one-time IRA withdrawal to cover the gap, they could eliminate their $1,500/month mortgage payment—and that single decision created a ripple effect that transformed their entire retirement strategy.

The Reverse Mortgage Conversation: A Five-Fold Ripple Effect

Once they saw how home equity could work within a broader strategy, the Johnsons recognized just how many problems this single move could help solve:

1. Eliminated the Mortgage Payment

The $22,000 IRA withdrawal paid off their mortgage and freed them from a $1,500 monthly obligation. Since they were using after-tax dollars, this was the equivalent of eliminating nearly $1,900/month in pre-tax income need.

2. Reduced or Paused IRA Withdrawals

No longer needing to pull $15,000/year to cover their living expenses, the Johnsons could let their IRA grow and explore Roth conversions during lower-income years—potentially reducing future tax burdens and Medicare costs.

3. Funded Permanent Life Insurance

Mr. Johnson had hoped to convert his term life policy to permanent coverage, but the $500/month premium had felt impossible. Now, with the mortgage gone, it became manageable—a meaningful step toward their legacy goals.

4. Rebuilt Liquidity and Flexibility

Even after paying for insurance, they had $1,000/month in freed-up cash flow. They could use this to replenish the $22,000 IRA withdrawal, build emergency savings, or begin planning ahead for long-term care expenses.

5. Delayed Social Security with Confidence

With reduced financial pressure, Mr. Johnson could now delay Social Security to full retirement age—or even age 70—maximizing his benefit. In the future, he could use part of that higher benefit to make voluntary payments into the reverse mortgage, unlocking a growing line of credit for future needs.

The Outcome: From Trade-Offs to Flexibility

In the end, the Johnsons didn’t have to sell their home. They didn’t have to accelerate IRA withdrawals. And they didn’t have to compromise their long-term goals just to meet short-term needs.

Instead, they:

Eliminated their monthly mortgage burden

Freed up nearly $2,000/month in income need

Funded permanent life insurance

Opened space for tax-smart Roth conversions

Created flexibility in their Social Security timeline

Preserved dignity—and harmony—in their retirement decisions

And they accomplished it all by strategically unlocking a portion of their housing wealth.

The Takeaway

A reverse mortgage isn’t just a loan—it’s a planning tool.

For the Johnsons, it became the keystone that pulled their entire retirement strategy into alignment. What began as a conversation about cash flow turned into a solution for tax efficiency, legacy planning, and long-term flexibility. But their transformation wasn’t just about numbers—it started with a shift in perspective.

Charles, like many advisors, once dismissed reverse mortgages based on hearsay and outdated beliefs. But after hearing a new narrative grounded in research, strategy, and real-world outcomes, he began to look deeper. What he discovered changed the way he served his clients.

Today, Charles includes a simple housing wealth assessment in every retirement readiness conversation with clients who own a home. He doesn’t push a product—he opens the door to a possibility. In his words:

“If we’re not at least evaluating the role of housing wealth, we’re leaving one of our clients’ biggest assets off the table. Sometimes, the smallest change—like eliminating a mortgage payment—creates the biggest planning freedom.”

Charles now sees reverse mortgages as more than a financial tool—they’re a conversation starter about efficiency, liquidity, and dignity in retirement. And the Johnsons’ story is a testament to what’s possible when planning evolves.

If you’re advising clients who are house-rich but income-constrained—or you’re looking for ways to solve multiple challenges with a single strategy—consider what home equity could unlock.

The myths are outdated. The strategy is real. And the results? For the Johnsons—and for advisors like Charles—they’ve been transformational.

Related Posts:

- 6 Ways Reverse Mortgages Can Manage Rising Insurance Costs

- Why Waiting to Secure a Reverse Mortgage Could be a Costly Mistake

- Can a Reverse Mortgage Happen When One Spouse is Under 62?

What to Do When You Have a Client or Case?

- Go to www.HousingWealthPro.com and request an Housing Wealth Illustration. Give Details in the “Notes” Section including the clients phone # if they would like a Housing Wealth Assessment. You can also

- Schedule a Time to Speak with Me: Click Here

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667.