Understanding the Closing Costs | What You Really Need to Know

One of the most frequently asked questions among financial professionals and their clients is, “What are the actual costs involved in obtaining a reverse mortgage?” While the structure of a Home Equity Conversion Mortgage (HECM) is relatively straightforward, the associated expenses can feel unclear or even overwhelming without a proper explanation.

This post will walk you through:

- The Three primary acquisition costs

- Which fees are paid out-of-pocket vs. financed into the loan

- Four Key questions every client should consider before moving forward

- Insight from top retirement researcher Dr. Wade Pfau

- Why the real question may not be “What does it cost?” but rather “What does it solve?”

🎥 Watch: Video Breakdown with Don Graves and Dr. Wade Pfau

In the video below, I explain the standard reverse mortgage closing costs and what they mean in practical terms. Note: In most cases, the only upfront costs are the counseling session and a portion of the appraisal. The rest is typically rolled into the loan.

That said, a reverse mortgage may not make sense for every homeowner. If someone plans to move soon, has limited home equity, or simply isn’t comfortable with the loan structure, it may not be the right fit. Like any planning tool, it’s only useful when it aligns with the bigger financial picture.

Still, one of the biggest misunderstandings about reverse mortgages is focusing only on the upfront cost. As I often explain, the real question isn’t just, “How much does it cost?” but, “What might it cost not to use it?” If a reverse mortgage reduces investment withdrawals, helps fund long-term care, or eliminates a mortgage payment, the benefit may far outweigh the initial expense.

In many cases, the real cost isn’t financial—it’s the missed opportunity, lost liquidity, or increased stress when retirement doesn’t go according to plan.

THE THREE COST CATEGORIES:

FHA Mortgage Insurance Premium (MIP)

Reverse mortgages are non-recourse loans, and that protection is made possible through FHA insurance.

- Upfront MIP: Equal to 2% of the appraised value or the FHA lending limit (whichever is lower). In 2025, that limit is $1,209,750.

- Ongoing MIP: Charged annually at 0.5% of the outstanding loan balance. This accrues and is repaid when the loan becomes due.

Why it matters: MIP ensures that borrowers continue receiving benefits—even if the lender goes out of business—and never owe more than the home’s value at repayment.

Origination Fee

Lenders may charge an origination fee to cover the cost of processing and underwriting:

- 2% of the first $200,000

- 1% of any amount above $200,000

- Capped at $6,000

This fee is typically financed, not paid upfront. Actual costs vary by lender and market conditions.

Third-Party, Title, and Closing Costs

These fees cover services needed to close and secure the loan. They often depend on the county and provider.

Common third-party fees include:

- Appraisal fee (typically paid out-of-pocket)

- Title insurance

- Recording fees

- Credit report, tax certification

- Notary, document prep

- Courier or delivery charges

- Mortgage payoff (if refinancing)

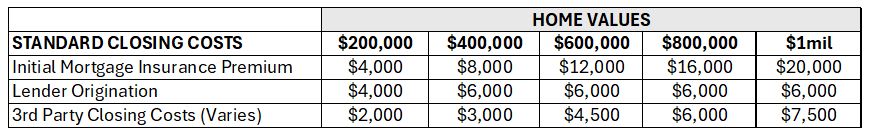

Example: Standard HECM Retail Acquisition Costs

Most of these costs are rolled into the loan.

💰 Out-of-Pocket Costs at a Glance

| Cost | Typical Range | Paid Upfront? |

|---|---|---|

| Counseling Session | ~$150 | ✅ Yes |

| Appraisal (Partial) | ~$300 collected upfront | ✅ Yes |

| Other Closing Costs | Varies | ❌ Financed |

Are Reverse Mortgages Worth the Cost?

Some clients understandably ask, “Is it too expensive?” It’s a fair question.

Dr. Wade Pfau, a leading retirement researcher, addressed this directly in the video above. In his research, he includes full retail costs—mortgage insurance, interest, origination, all of it. And even with those included, his studies show that reverse mortgages can improve retirement outcomes when used strategically.

In one case study, a retiree who coordinated their withdrawals with reverse mortgage funds ended retirement with $4 million more in total assets than someone who didn’t use one. The reverse mortgage didn’t take money away from the estate—it preserved it.

That leads to a bigger, more personal question—how do you know if a reverse mortgage is the right move for your situation? Cost alone doesn’t determine value. It comes down to whether the reverse mortgage helps solve a real problem, reduce a meaningful risk, or provide a better path forward compared to other options.

🧩 Four Questions to Ask Before Moving Forward

Reverse mortgages are not one-size-fits-all. Before moving forward, it’s important to pause and ask the right questions — not just about costs, but about purpose, fit, and alternatives. These four questions can help you (or your client) frame the reverse mortgage as a strategic planning tool — not just another loan.

1. What problem does it solve?

Is there a gap in monthly cash flow? Is there lingering mortgage debt that’s limiting flexibility? Does the plan rely too heavily on investment withdrawals? Identifying a clear problem the reverse mortgage is meant to address is the first step toward determining its value.2. What risk does it insure?

Retirement is full of uncertainties: longevity, market volatility, long-term care, inflation, taxes, and more. A reverse mortgage can act as a buffer — protecting against poorly timed withdrawals, helping cover unexpected expenses, or reducing sequence of return risk.3. What expense do I bear (or does my house cover it)?

Most reverse mortgage costs are financed, not paid out-of-pocket. In many cases, the home’s value — not the client’s savings — absorbs the expense. Understanding what you’re really giving up (and what you’re protecting) is key.4. What alternative works better?

If not a reverse mortgage, then what? Downsizing, draining savings, asking family for help, or simply doing nothing? Comparing the reverse mortgage to the real-life alternatives helps put its pros and cons in perspective.These aren’t just financial questions — they’re planning questions. And when clients work through them thoughtfully, they can make a confident and informed decision that aligns with their broader retirement goals.

🛠️ What Other Options Should Be Considered?

Even if a reverse mortgage sounds appealing, it should only be used if it’s clearly the best available option. Not just a convenient one.

Short of winning the multi-state Powerball, here are eight alternatives I’ve walked through with clients over the past 25 years. In many cases, they fall short. But each deserves consideration as part of a complete conversation.

1. Sell the home and downsize

This is often the first option people think of. For some, it’s a smart move. For others, it means giving up a familiar home, taking on new expenses, or winding up with less financial flexibility than expected.

2. Use existing cash or retirement savings

Tapping into a 401(k), IRA, or savings account might solve the short-term need. But it could trigger unexpected taxes, reduce future income, or shorten the lifespan of the retirement plan.

3. Ask family for support

Some people can lean on their children or relatives for help. Others are uncomfortable with that idea, don’t want to be a burden, or simply don’t have that option.

4. Take in a roommate or renter

Renting out a room can bring in income, but it changes the feel of the home. And not everyone wants to share their space in retirement.

5. Go back to work

Picking up a part-time job may sound practical, but not everyone has the energy, health, or desire to return to work later in life.

6. Seek help through state or local programs

There are property tax relief programs, utility support, and other benefits that can help. However, they rarely address the larger financial gaps like mortgage payoff or ongoing income needs.

7. Refinance or take out a traditional home equity loan

This may work for some, but these options require monthly payments and qualifying can be tough when income is fixed.

8. Do nothing

Sometimes people decide to wait and hope the situation improves on its own. That is always an option, but in many cases, waiting simply adds pressure or limits choices down the road.

These alternatives aren’t wrong. In fact, they’re part of a well-rounded financial discussion. A reverse mortgage should only move forward if, after weighing the options, it clearly solves the problem more effectively and with fewer trade-offs.

✅ Final Thoughts

After exploring the core costs, key questions, and practical alternatives, the final consideration is whether a reverse mortgage truly supports the client’s overall retirement plan. For many, it can unlock options that weren’t otherwise available. For others, it may serve as a backup strategy or simply confirm that another path is better. Either way, the goal is clarity and confidence moving forward.

Reverse mortgage costs can look high, but most are financed. When used with wisdom and planning, this tool can offer long-term value and help address real retirement risks.

The question isn’t only “What does it cost?” but “What does it solve?”

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667.

2 thoughts on “Understanding the Acquisition Costs of a Reverse Mortgage”

Hi Don. Thanks for keeping me in the loop. I appreciate it. I talked to Emily today and wished her well. Nice gal. I always appreciate the emails and videos you provide. You are a great ambassador for the Industry. My compliments. Have a Great Thanksgiving and a Merry Christmas,

Hi Mr. Whidden, Thank you for the compliment! We are honored to know you. We hope you have a wonderful holiday season!