Rethinking Social Security with Housing Wealth

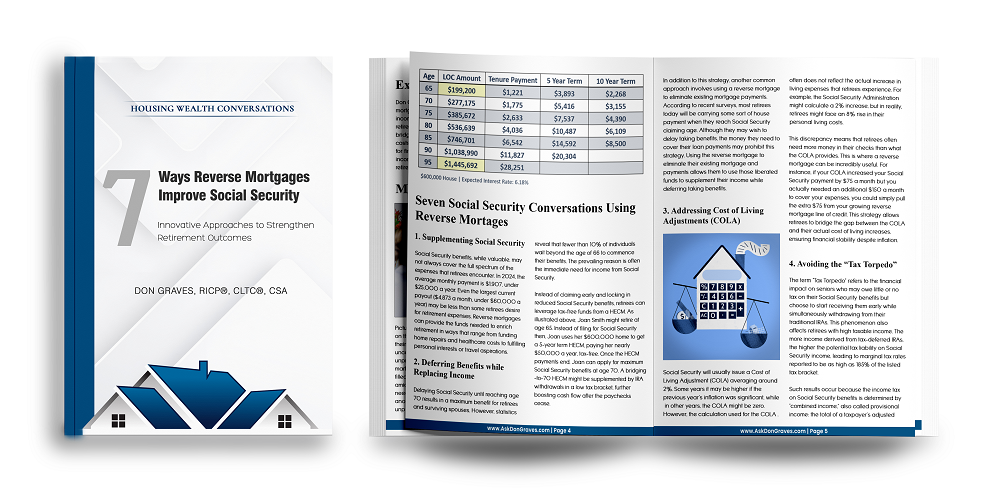

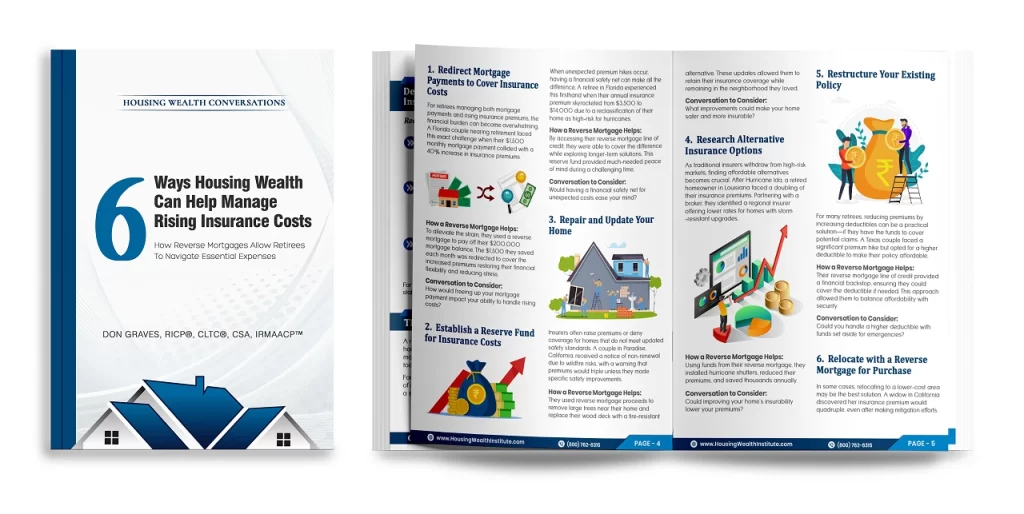

For many retirees, Social Security is the cornerstone of their retirement income. But what if there were ways to stretch those benefits further, reduce taxes, and build more flexibility into a retirement plan?

That’s where housing wealth can play a role. In this article, I explore how reverse mortgages can support Social Security strategies—helping clients delay benefits, avoid the tax torpedo, and manage IRMAA premiums.

Fill out the form below to get your free download.

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667.