Navigating the Homeowners Insurance Crisis

While recent wildfires in Los Angeles, hurricanes in Florida, and mudslides in North Carolina dominate the headlines, skyrocketing homeowners insurance premiums are a growing crisis nationwide. Natural disasters fueled by climate change, combined with inflation and regulatory hurdles, are driving insurers to raise premiums, restrict coverage, or exit high-risk markets altogether.

Retirees—many of whom live on fixed incomes—are particularly vulnerable, often facing difficult choices between maintaining their coverage and meeting essential expenses. And while the headlines may focus on disaster-prone states, no region is immune to these cost increases, leaving financial advisors with a unique opportunity to step in as problem-solvers.

A reverse mortgage (RM) offers a powerful, often-overlooked solution to this challenge. Below, we’ll examine the problem in detail and introduce six creative ways a reverse mortgage can help retirees address rising homeowners insurance premiums while preserving their financial security.

A Personal Message from Don Graves

Defining the Problem: Insurance Costs Are Out of Control

The cost of homeowners insurance has surged in recent years, driven by climate-related disasters, inflation, and insurance companies withdrawing from high-risk markets. For instance:

- California’s Crisis: Many insurers have stopped offering policies in wildfire-prone areas. Residents are either denied coverage outright or face premiums that have quadrupled.

- Nationwide Impact: Premiums have risen an average of 17.4% for new policies in 2024, with renewals increasing as much as 69% for some homeowners since 2021.

- Difficult Choices: Families are being forced to either cut back on other essentials, self-insure, or consider moving to less costly areas

For retirees on fixed incomes, these increases can be devastating, jeopardizing their financial stability and retirement plans.

The Reverse Mortgage Advantage

A reverse mortgage allows retirees aged 62 and older to convert a portion of their home equity into tax-free funds, without requiring monthly mortgage payments. The most common use is establishing a growing line of credit—a flexible financial tool that increases over time, even if home values decline.

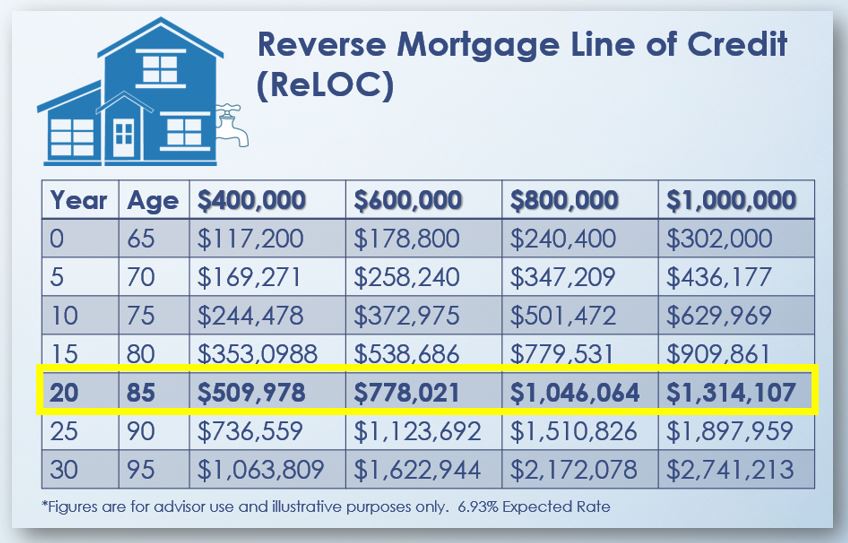

For example, a 65-year-old couple living in a $600,000 home could establish a $178,800 line of credit. This line of credit grows annually based on the unused balance, forming the foundation for the six strategies we’ll discuss. Notice that the unused portion has grown to $778,000 in 20 years.

This growing line of credit provides retirees with a safety net to address rising costs, including homeowners insurance, without jeopardizing their other assets or monthly cash flow.

By using the line of credit strategically, retirees can fund necessary home updates, build reserves for unexpected expenses, restructure policies, shop for better rates, or even relocate—all while maintaining financial stability. This flexibility makes reverse mortgages a valuable tool for financial advisors to recommend in today’s challenging environment.

Six Strategies to Manage Rising Insurance Costs with a Reverse Mortgage

This article outlines six powerful ways reverse mortgages can help retirees manage escalating insurance costs. Paired with real-life examples, these strategies will equip financial advisors to provide actionable solutions to their clients—whether they live in wildfire-prone California, hurricane-hit Florida, or seemingly low-risk areas experiencing sudden premium hikes.

1. Redirect Mortgage Payments to Cover Insurance Costs

The Problem: Rising premiums can strain fixed incomes, especially when combined with existing mortgage payments.

Story: A Florida couple nearing retirement had a $200,000 mortgage with a $1,500 monthly payment. Their insurance premiums jumped by 40%, creating financial strain.

Solution: They used a reverse mortgage to pay off their mortgage balance, redirecting the $1,500 saved each month to cover increased premiums.

Conversation to Consider: How would freeing up your mortgage payment impact your ability to handle rising costs?

2. Establish a Reserve Fund for Insurance Costs

The Problem: Unexpected premium hikes can leave retirees scrambling for resources.

Story: A retiree in Florida was blindsided when their insurance premium jumped from $3,500 to $14,000 per year due to reclassification of their home as high-risk for hurricanes.

Solution: They accessed their reverse mortgage line of credit to cover the difference while exploring longer-term solutions.

Conversation to Consider: Would having a financial safety net for unexpected costs ease your mind?

3. Repair and Update Your Home

The Problem: Insurers may increase premiums or deny coverage if homes do not meet updated safety standards.

Story: A couple in Paradise, California, received a notice of potential non-renewal from their insurer due to wildfire risks. They were told their premiums would triple unless they removed large trees near their home and replaced their wood deck with a fire-resistant alternative.

Solution: Using a reverse mortgage, they completed the updates and retained their coverage while staying in the neighborhood they love.

Conversation to Consider: What improvements could make your home safer and more insurable?

4. Research Alternative Insurance Options

The Problem: Many traditional insurers exit high-risk markets, leaving limited and costly options.

Story: After Hurricane Ida, a retired homeowner in Louisiana saw their insurance premiums double. With many traditional carriers exiting the state, they partnered with a broker to find a regional insurer offering lower rates for homes with storm-resistant upgrades.

Solution: By using reverse mortgage funds, the homeowner installed hurricane shutters, reducing premiums and saving thousands annually.

Conversation to Consider: Could improving your home’s insurability lower your premiums?

5. Restructure Your Existing Policy

The Problem: Lower premiums often come with higher deductibles, which may strain resources in case of a claim.

Story: A couple in Texas faced a significant premium increase. To make it affordable, they opted for a higher deductible but worried about paying out-of-pocket in the event of a claim.

Solution: Their reverse mortgage line of credit gave them peace of mind, providing funds to cover the deductible if needed.

Conversation to Consider: Could you handle a higher deductible with funds set aside for emergencies?

6. Relocate with a Reverse Mortgage for Purchase

The Problem: Some areas face insurmountable premium increases despite mitigation efforts.

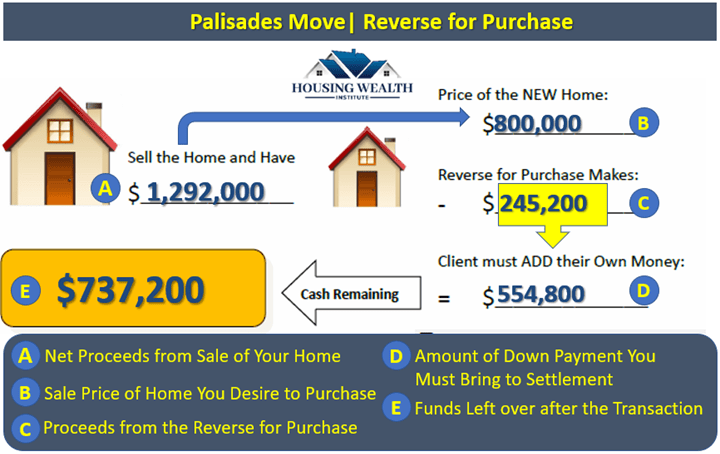

Story 1: A widow in California discovered her insurance premium would quadruple, even after mitigation efforts. She sold her house, paid off the existing mortgage, and relocated to Nevada, where insurance premiums were lower. Using a Reverse Mortgage for Purchase, she bought a new home with no monthly mortgage payments and added $737,000 back to her retirement savings.

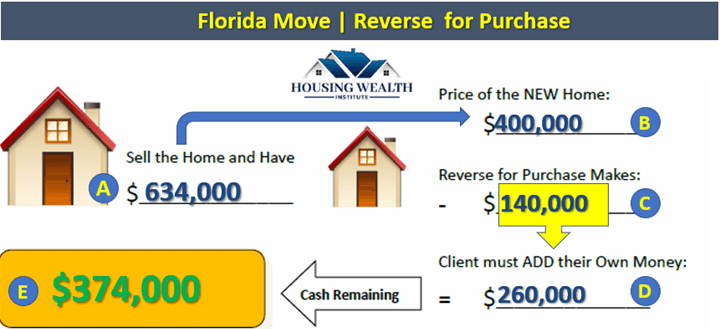

Story 2: A Florida widow faced tripled insurance premiums. She sold her home, relocated to a less expensive area, and used a Reverse Mortgage for Purchase to secure her new home, adding $374,000 back to her retirement savings.

Conversation to Consider: Would relocating to a lower-cost area improve your financial security and peace of mind?

Learn More About Reverse for Purchase:

Reverse for Purchase Masterclass

Why This Matters for Financial Advisors:

Helping clients navigate the increasing costs of insurance is more than just a financial strategy—it’s an opportunity to build lasting trust, strengthen your client relationships, and differentiate your practice. By integrating reverse mortgages into your toolkit, you’re offering much more than a solution to high insurance premiums. You’re providing your clients with the financial flexibility they need to address a range of retirement challenges. This flexibility can free up cash flow, reduce financial stress, and enable clients to live their retirement years with confidence and peace of mind.

Incorporating reverse mortgages into your planning process not only enhances your value as an advisor but also positions you as a trusted resource in the ever-evolving retirement landscape.

If you’re ready to explore how reverse mortgages can benefit your clients, take the next step today.

Find out how much your clients may be eligible for by visiting www.HousingWealthPro.com. or Contact Us to schedule a discovery call.

It’s time to unlock the full potential of home equity and give your clients the financial security they deserve.

What to Do When You Have a Client or a Case?

- Go to www.HousingWealthPro.com and request a Housing Wealth Illustration. Give Details in the “Notes” Section including the clients phone # if they would like a Housing Wealth Assessment. You can also

- Schedule a Time to Speak with Me: Click Here

Citations

1. New York Post: “America is running out of home-owners insurance.” New York Post. January 6, 2024.

https://nypost.com/2024/01/06/real-estate/america-is-running-out-of-home-owners-insurance/

2. Fox Business: “Surging home insurance costs could force families to leave these 10 states.” Fox Business. January 6, 2024.

https://www.foxbusiness.com/economy/surging-home-insurance-costs-could-force-families-leave-these-10-states

3. HousingWire: “Surging home insurance premiums challenge mortgage industry, regulators.” HousingWire. January 6, 2024.

https://www.housingwire.com/articles/surging-home-insurance-premiums-challenge-mortgage-industry-regulators/

The content of this blog is for financial advisors and professionals only and is not intended for consumer use. Names, cases, and scenarios are fictionalized for illustrative purposes. The opinions expressed here are those of the author alone and do not reflect the views of any affiliated entities or individuals. Don Graves, NMLS #142667.