What We Do

We Teach Advisors How to Have Educated Conversations about Reverse Mortgages

We specialize in training financial advisors on how to have educated conversations about reverse mortgages. Our goal is to equip advisors with the insights they need to incorporate housing wealth into comprehensive retirement plans, benefiting both their clients and their practices.

Who We Are

The Housing Wealth Institute with Don Graves,

RICP®, CLTC®, CSA® Certified Senior Advisor

We are dedicated to educating financial professionals on the strategic integration of reverse mortgages into retirement planning. Our mission is to empower advisors with the knowledge and tools they need to enhance their clients’ financial security.

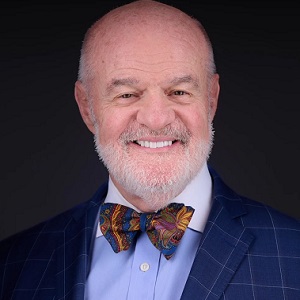

Meet Don Graves

Don Graves, RICP®, CLTC®, CSA®

Certified Senior Advisor

- President and founder of The Housing Wealth Institute.

- Author of three books on retirement planning.

- Instructor and content contributor at The American College of Financial Services.

- Quoted in Forbes Magazine and featured on PBS-sponsored shows.

- Recognized as one of the American College’s Top 11 Retirement Income Leaders.

Don has distilled his extensive experience into practical, back-of-the-napkin concepts. His strategies help asset managers, insurance agents, and hybrid advisors attract new clients, strengthen existing relationships, and generate more revenue.

How We Do It

Engaging and Educational Formats

- Webinars and Workshops

- Podcast / Broadcasts

- Keynotes / Breakout Sessions

- Masterminds/Study Groups/Team Trainings/Lunch and Learn

Our methods are designed to be interactive, informative, and tailored to the needs of financial professionals.

Three Ways to Work with Don Graves

Education

Don Graves offers comprehensive educational resources on reverse mortgages though seminars, webinars, articles and personalized educational sessions.

Consultation and Case Design

Don collaborates closely with financial professionals to tailor specific strategies that integrate reverse mortgages into holistic retirement plans.

Equity Release Assistance

Don partners with a specialized team to facilitate the reverse mortgage origination process from consultation to closing.

Testimonials

What Others Are Saying!

TOM HEGNA, CLU, CHFC, CASL

Economist, Speaker, and Best-Selling Author

“I was skeptical of reverse mortgages…but, Don shows you things [about them] you had no idea were even available. When you combine housing wealth with other retirement assets, a whole new dimension is added to what can be accomplished.”

DAVID MCKNIGHT

Best-Selling Author, Power of Zero: The Tax Train is Coming

“The thought leaders have spoken, and I concur, when you utilize reverse mortgages, you increase the likelihood of a positive outcome in retirement.”

ED SLOTT, CPA

Author and founder of www.irahelp.com Founder of Ed Slott’s Elite IRA Advisor GroupSM

“Financial advisors who want to grow their business need to know how to help clients leverage their untapped wealth. Don continues to make the case for tapping into an underperforming asset and the difference reverse mortgages can possibly make in creating

retirement security.”

DR. ROBERT C. MERTON

Distinguished Professor of Finance, MIT Sloan School & Nobel Laureate – Economics 1997

“Reverse Mortgages are a potential solution to the global retirement funding crisis.”

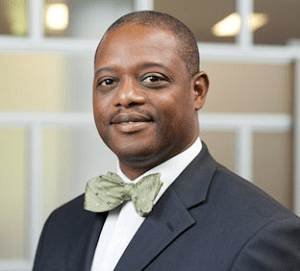

DR. ROBERT “BOB” JOHNSON, CFA®, CAIA®

Past President, The American College of Financial Services

“Don’s expertise in the area of HECM education set the bar in the RICP program at the American College as well as within our very own industry walls. His knack to completely flip the connotation of the reverse mortgage and communicate complex strategies with ease and enthusiasm during his training workshops is a specific strength of his I admire greatly.”

WADE PFAU, PHD, CFA

Former Professor of Retirement Income and RICP® Program Director at The American College | Founder of RetirementResearcher.com

“I have had the pleasure of working with Don Graves at the American College, and his ability to simplify the complexities of reverse mortgages is exceptional. His extensive knowledge,

practical experience and communication style make his training an immense value to any group. In fact, Don was the one who helped me get started in my exploration of reverse mortgages as a retirement income planning tool. Since then, I’ve written extensively on the topic. I would highly recommend Don as a resource for your next event.”

HEATHER SCHREIBER, RICP, NSSA

Founder and President of HLS Retirement Consulting, LLC

“Don opened my eyes to a stream of tax-free wealth for individuals in diverse categories. I have adopted what I learned from Don about using a HECM into my consulting practice.”

JOE JORDAN

International Speaker, Behavioral Finance Expert

“Like many in the financial service world, I was very skeptical of reverse mortgages. Don Graves helped me over that skepticism.”

JAMIE HOPKINS ESQ., LLM, CFP®, CHFC®, CLU®, RICP®

CEO of Bryn Mawr Capital Management

“After working with Don Graves at the American College, my opinion on reverse mortgages was turned upside down. Through powerful words and simplified language, Don will transform your perception and provide impactful strategies”

C.W. Copeland, Ph.D., ChFC®, CLU®, RICP®

Assistant Professor at The American College for Financial Services

“Every financial advisor worth their salt should have a cursory knowledge of reverse mortgages, in order to, at a minimum, factor them out of their client’s equation.”